Distributed Energy Resources & Flexibility: The Backbone of the Future Grid

The Three "D"rivers: Digitalisation, Decentralisation and Decarbonisation

Introduction (The Three “D”rivers)

The global energy landscape is undergoing a radical transformation, driven by the three D’s - digitalisation, decentralisation and decarbonisation. Together, they create a powerful, reinforcing feedback loop.

Energy needs are rising across both developed and emerging markets - albeit for different reasons. Most of the new generation capacity to match this demand comes from renewable energy sources like solar and wind, which are inherently intermittent. The increasing share of intermittent generation puts additional stress on aging electricity grid infrastructure, already hampered by years of underinvestment in digitalisation and data systems. The result is a grid with limited visibility - a system increasingly unfit for purpose in a world shifting to a clean distributed energy.

Redefining Energy Infrastructure: Decentralized Grids and Flexibility

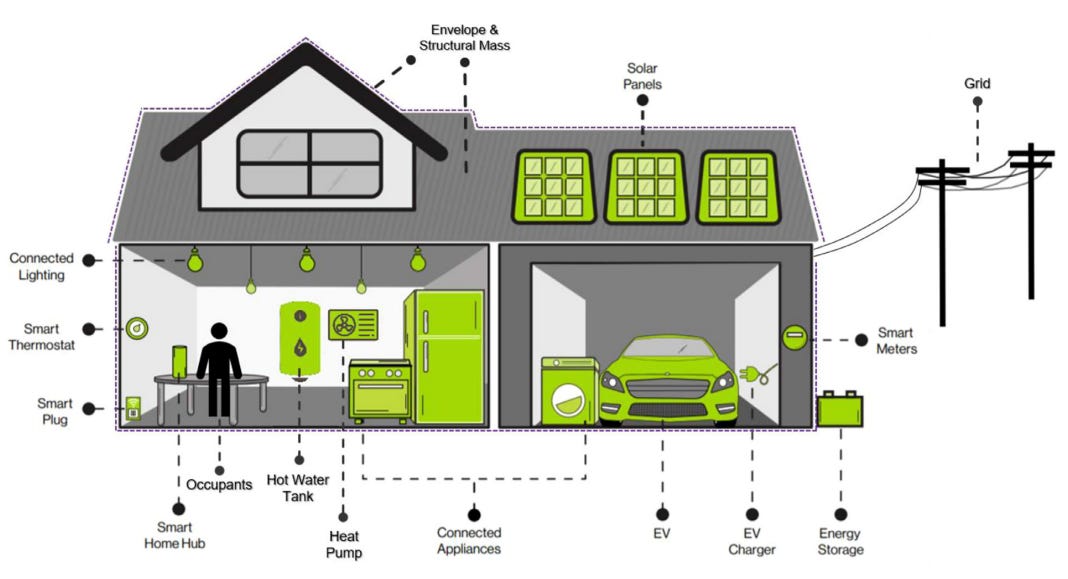

A decentralised grid shifts from centralised power plants to localised energy generation, storage, and demand management. This system leverages mostly renewable resources like rooftop solar, batteries and smart devices to enable bidirectional flows and real-time balancing.

At the heart of this new model lies flexibility: the ability of both supply and demand to respond in real-time to price signals or grid conditions. Think electric vehicles (EVs) charging during times of surplus solar generation or industrial plants briefly scaling back during peak demand.

Why flexibility matters:

Renewable energy sources like wind and solar are inherently variable.

Electrification of transport and heating increases peak electricity demand.

Smart load management avoids costly grid upgrades and high operations cost.

Flexibility is delivered by distributed energy resources (DERs), which are indispensable building blocks of tomorrow’s grid. DERs are small-scale assets that can be located on either side of the electricity meter (“behind the meter” or “in front of the meter”). DERs include distributed generation assets (e.g., on-site solar generation), battery energy storage assets (stationary BESS assets or EV charging) and demand side response (DSR), which include loads such as heat pumps in residential units or manufacturing assets in an industrial plant.

Different Roles of DERs in Developed and Developing Markets

The reasons for deploying DERs differ across regions.

Developed Markets (UK / EU / US):

In advanced economies, DERs support the shift toward a low-carbon, digital, and flexible grid. As renewables gain share, and EVs and heat pumps add stress to peak demand, DERs provide localised balancing and resilience.

Key dynamics:

Clean energy integration: DERs help manage variability from renewables.

Grid optimisation: DERs support dynamic load shifting, reducing need for grid upgrades.

Economic opportunities: Consumers monetise DERs via DSR programs and market participation.

Markets like Germany, California, and the UK are enabling DERs to play across multiple markets — including capacity, balancing, and ancillary services — while encouraging aggregation through favourable policies.

Developing Markets (India / Sub-Saharan Africa):

In contrast, DERs in developing countries address energy access, reliability, and energy security.

Key dynamics:

Energy inclusion: Approximately 800 million people lack reliable electricity access. DERs — especially solar plus storage — offer fast, modular solutions.

Avoiding centralised infrastructure: DERs bypass expensive transmission build-outs.

Fuel independence: Reducing reliance on imported fossil fuels enhances energy security.

Governments are deploying distributed solar, battery storage, and EV charging loads in areas underserved by the main grid.

Despite different drivers, both regions arrive at the same destination: a decentralized, flexible energy system that maximises the value of local resources.

Adoption of DERs: Key Factors and Barriers

There are several factors that drive the adoption of DERs. As the below chart from an Oct-2023 report by the Oxford Institute for Energy Studies shows, regulatory, technical and market-related factors have to come together to accelerate the adoption of DERs. Consequently, the lack of these factors prevents a large-scale adoption.

Examples of key challenges include:

Regulatory Fragmentation: In the case of Europe, different market rules across countries.

Technological Hurdles: Legacy equipment in majority of industrial facilities lacks smart controls.

Market Design: Large part of flexibility value remains uncaptured due to imperfect price signals.

Industrial Risk Aversion: Manufacturing plants might be hesitant to participate in DSR programs due to fears of disrupting core operations or risking business continuity. Flexibility solutions must respect operational constraints and offer reliable value without compromising production. As automation and digitalisation advance, these concerns may diminish, enabling more industrial facilities to participate in flexibility markets without compromising production.

From Challenge to Opportunity: Mastering Flexibility

Despite the barriers, the value of flexibility is already visible. Early movers are reaping tangible benefit. The next-generation grid won’t be built solely through hardware upgrades or mega projects, but through intelligent coordination of distributed assets.

Reforming market signals, modernising infrastructure, and aligning regulation will be essential steps. But the direction is clear: those who embrace flexibility today will lead the energy systems of tomorrow. In a decentralised future, flexibility is no longer optional — it’s the foundation of resilience.