Building a Regulated and Borderless Crypto World

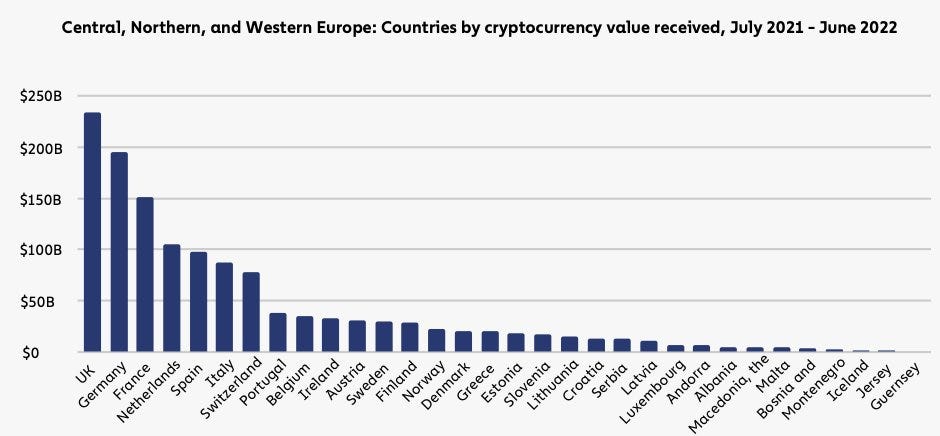

According to the latest Geography of Cryptocurrency report published by Chainalysis, Western Europe is the world's largest crypto economy with $1.3 trillion worth of cryptocurrency received between July 2021 - June 2022.

The report refers to regulatory clarity as a critical driver of adoption and larger transaction volume across Europe, which I agree with. EU-wide efforts like crypto travel rule and MiCA licensing regime show the clear and strong intention of EU policymakers.

It is great for Europe from the perspective of 'leading the race' to become the crypto hub of the world. However, without a coordinated global effort to create a unified framework, it might lead to problems.

We all agree that crypto (DeFi in particular) should be borderless (e.g. remittance). That is the spirit. And we can summarize the main reasons why traditional cross-border remittance is expensive and slow as FX conversion, liquidity and security (AML / CFT checks, etc.).

I am wondering if creating a big disparity in robustness of regulatory framework and the underlying policies across different jurisdictions might lead to creation of these islands and again high transaction costs between regions. Take Turkey for example.

In the report, it is shown as part of Middle East & North Africa (Nothing wrong with that, Turkey is not part of EU). Cryptocurrency value received for the same period July 2021 - June 2022 is almost $200bn, same as Germany and much higher than rest of Europe.

Now I have to admit I am not into the details of how the travel rule of MiCA would work with respect to Turkey (or any other country). But my point is that Turkey, since it is not in the EU, is probably not involved in any of this huge effort to push EU regulation for crypto.

Despite massive crypto adoption and strong talent in crypto, they might still carry the risk of being left out in the new world, while sitting right next to EU. In the world that is supposed to be borderless and inclusive in the first place.